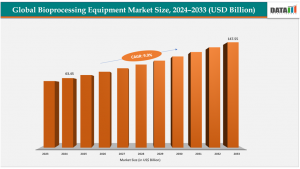

Bioprocessing Equipment Market to Reach US$147.55 Billion by 2033 at 9.9% CAGR | DataM Intelligence

Bioprocessing equipment market to reach US$147.55B by 2033, propelled by biologics demand, CDMO capacity growth, and rapid adoption of single-use technologies.

Rising biologics, cell therapy pipelines, and single-use adoption are transforming global biomanufacturing capacity requirements.”

LOS ANGELES, CA, UNITED STATES, November 14, 2025 /EINPresswire.com/ -- Global bioprocessing equipment market size reached US$ 58.14billion with rise of US$63.45billion in 2024 is expected to reach US$ 147.55billion by 2033, growing at a CAGR of 9.9%during the forecast period 2025-2033.— DataM Intelligence

Get a Free Sample Research PDF: https://datamintelligence.com/download-sample/bioprocessing-equipment-market

USA - Industry Latest News 2025:

✅ 25 Feb 2025 — Thermo Fisher announced plan to acquire Solventum’s Purification & Filtration business.

✅ 14 Jul 2025 — Waters Corporation to merge with Becton, Dickinson’s Biosciences & Diagnostic Solutions in a ~$17.5B deal (major consolidation in bioseparations/analytics).

✅ 29 Jul 2025 — Cytiva (bioprocessing division) launched the ÄKTA readyflux TFF system 500 for smaller-scale manufacturing (new product launch).

Japan - Industry Latest News 2025:

✅ 08 Apr 2025 — AGC Biologics announced installation of two 5,000 L Thermo Scientific DynaDrive single-use bioreactors at its new Yokohama CDMO facility (large-scale SUB deployment).

Korea - Industry Latest News 2025:

✅ Apr 2025 — Samsung Biologics brought its Plant-5 / Bio Campus II capacity online (Plant 5 operational timeline targeted for April 2025 — major capacity expansion).

✅ Jul 2025 — Thermo Fisher opened/expanded bioprocess support presence in Korea with a Bioprocess Design / Supply centre in the Songdo bio cluster (local service & tech centre).

Europe - Industry Latest News 2025:

✅ 01 Jul 2025 — Sartorius completed the acquisition of MatTek Corp (microtissue/3D-models business) — M&A to broaden cell-culture/cell-analysis portfolio.

✅ 17 Jun 2025 — Sartorius Stedim Biotech announced expanded manufacturing and R&D capacities in Aubagne, France (single-use bag production, automated lines).

✅ 15 Oct 2025 — Merck (Germany) announced agreement to acquire the chromatography business of JSR Life Sciences (major bioseparation-related M&A in Europe).

Market Geographical Share:

North America holds a significant share of the global bioprocessing equipment market, driven by a strong presence of biopharmaceutical manufacturers, advanced bioprocessing infrastructure, and consistent investment in biologics and biosimilar development. The U.S. leads the region with high adoption of single-use systems, continuous bioprocessing technologies, and large-scale biomanufacturing capabilities.

Europe accounts for a major portion of the market, supported by a mature biotechnology ecosystem, government-backed research funding, and strong demand for monoclonal antibodies, cell & gene therapies, and vaccines. Countries such as Germany, the U.K., and France remain key contributors due to their expanding GMP-certified production facilities.

The Asia-Pacific region is witnessing the fastest growth, driven by expanding biopharma manufacturing capacity in China, India, South Korea, and Singapore. Cost-efficient production, rising biologics demand, and government initiatives supporting biotech innovation continue to attract global CDMOs and equipment manufacturers to the region.

Market Drivers:

✅ Rising Demand for Biologics

Growing prevalence of chronic diseases has accelerated the development of biologics, monoclonal antibodies, recombinant proteins, and cell therapies—driving significant need for advanced bioprocessing systems.

✅ Expansion of Biomanufacturing Capacity

Biopharmaceutical companies and CDMOs continue expanding large-scale and flexible manufacturing facilities, increasing demand for fermenters, bioreactors, filtration systems, and purification equipment.

✅ Shift Toward Single-Use Technologies

The industry is rapidly adopting single-use bioprocessing systems due to their lower contamination risk, reduced cleaning requirements, and operational efficiency, especially in small-batch and clinical-scale production.

✅ Growth of Cell & Gene Therapy Development

Rising pipelines for gene therapies, viral vectors, and regenerative medicine products require highly specialized bioprocessing technologies, boosting demand for scalable and automated systems.

✅ Technological Advancements and Automation

Integration of automation, real-time monitoring, AI-driven analytics, and continuous processing improves product yield and consistency, encouraging manufacturers to upgrade bioprocessing infrastructure.

✅ Increased Vaccine Production

Post-pandemic expansion of global vaccine production capacity has accelerated investments in upstream and downstream bioprocessing equipment across emerging and established manufacturing hubs.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/bioprocessing-equipment-market

Segments Covered in the Bioprocessing Equipment Market:

By Product Type (Bioreactors, Filtration Systems, Chromatography Systems Cell Culture Systems, Mixing Systems, Control & Monitoring Systems, Others)

By Process (Upstream Processing, Downstream Processing)

By Application (Vaccines, Gene & Cell Therapy, Monoclonal Antibodies (mAbs), Recombinant Proteins, Others)

By End User (Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Academic & Research Institutes)

Regional Analysis for Bioprocessing Equipment Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Buy Now & Get 30% OFF — Grab 50% OFF on 2+ reports: https://www.datamintelligence.com/buy-now-page?report=bioprocessing-equipment-market

Major Key Players: Thermo Fisher Scientific, Inc., Sartorius AG, Danaher Corporation (Cytiva), Merck KGaA, Eppendorf, Bionet, Solaris Biotech, PBS Biotech, Inc., Applikon Biotechnology (Getinge / Applikon) and Celartia.

✅ Sartorius AG: Market leader in single-use and bioprocess solutions generated ~€3.4 billion sales in 2024 with Bioprocess Solutions a core revenue driver (large share in single-use consumables, filters, bioreactors).

✅ Danaher Corporation (Cytiva/Pall): Major global player in upstream/downstream bioprocessing — Danaher’s bioprocess franchises (notably Cytiva/Pall) represent a multibillion-dollar business (~$5–7B scale in recent disclosures) and are widely used by CDMOs and pharma manufacturers.

✅ Merck KGaA (MilliporeSigma): Large life-science incumbent with extensive bioprocessing portfolio (filtration, chromatography, media) — part of a healthcare/life-science group with ~€21.2B group sales (2024) and active M&A to strengthen bioprocessing capabilities.

✅ Eppendorf: Mid-market specialist focused on lab and small-scale bioreactors, instruments and consumables ~€980M revenue in 2024, positioning it as a key supplier for research & process development rather than large commercial manufacturing.

✅ Bionet: Niche bioreactor/fermenter manufacturer (benchtop → industrial) with a strong product range (single-use and multi-use bioreactors) used by academic labs and regional manufacturers notable for flexible lab-to-pilot solutions in APAC/EMEA.

✅ Solaris Biotech: European (Italy) supplier of benchtop, pilot and industrial bioreactors and filtration systems a specialist OEM serving research and small-to-mid commercial processes (focused product portfolio rather than mass market share).

✅ PBS Biotech: Fast-growing niche player in single-use vertical-wheel bioreactors for cell & gene therapies and cell-based manufacturing small relative revenue vs majors but strong adoption in cell-therapy process development (recent estimated revenue in the low-tens of millions).

Unlimited Insights. One Subscription: https://www.datamintelligence.com/reports-subscription

Related Reports:

Bioprocess Automation and Control Software Market

Biotechnology Market 2025

Kailas Disale

DataM Intelligence 4market Research LLP

+1 877-441-4866

kailas@datamintelligence.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.