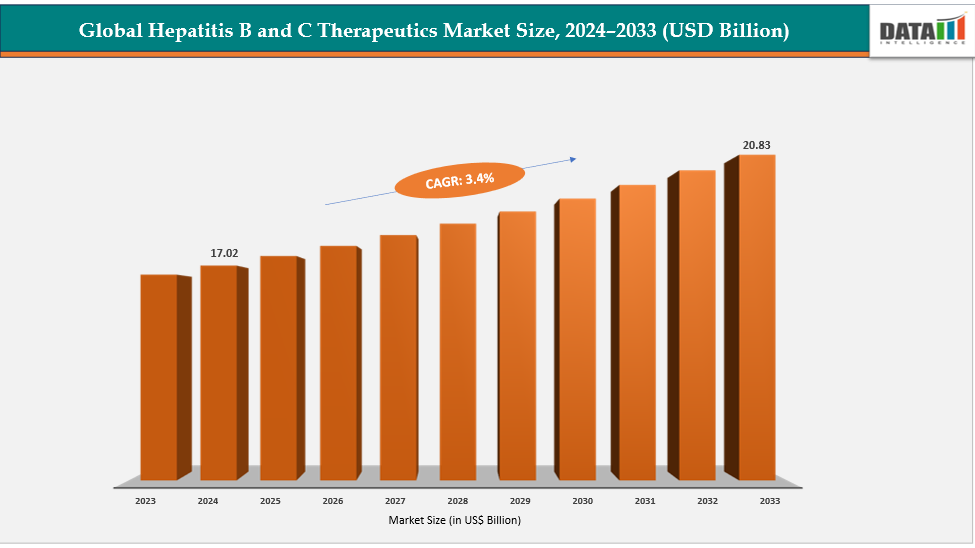

Hepatitis B & C Therapeutics Market to Hit US$ 20.83 Billion by 2033 at 3.4% CAGR | DataM Intelligence

Global hepatitis B & C therapeutics market to hit US$ 20.83B by 2033, supported by antiviral advancements, vaccination programs & rising screening initiatives.

Accelerated screening, novel antivirals, and strong elimination targets are reshaping the future of HBV and HCV treatment worldwide.”

LOS ANGELES, CA, UNITED STATES, November 14, 2025 /EINPresswire.com/ -- Global hepatitis B and C therapeutics market size reached US$ 17.02 billion in 2024 is expected to reach US$ 20.83 billion by 2033, growing at a CAGR of 3.4% during the forecast period 2025-2033— DataM Intelligence

Get a Free Sample Research PDF: https://datamintelligence.com/download-sample/hepatitis-b-and-c-therapeutics-market

USA - Industry Latest News 2025:

✅ 06 Jan 2025 — FDA published draft guidance on donor-eligibility to reduce the risk of transmission of HBV/HCV.

✅ 17 Mar 2025 — FDA cleared the IND for PBGENE-HBV (Precision BioSciences) first-ever in-vivo gene-editing candidate to enter trials for chronic HBV.

✅ 11 Jun 2025 — FDA granted an expanded indication to AbbVie’s MAVYRET (glecaprevir/pibrentasvir) to treat acute HCV (8-week oral DAA regimen).

✅ 22 May 2025 — Gilead paid to take sole ownership of Hookipa’s arenaviral HBV/HIV vaccine programmes (asset transfer / strategic buy-in).

✅ 19 Feb 2025 — Investor Deep Track launched a proxy fight at Dynavax pressing the company to prioritise its HBV vaccine (Heplisav) strategy.

Japan - Industry Latest News 2025:

✅ 16 Jan 2025 — Korea University–style clinical/registry signals reported in region (Japanese investigators continuing expanded HBV/HCV real-world prescribing and DDI research in 2025).

✅ 2025 (throughout) — GSK’s bepirovirsen (ASO for CHB) continued to feature in Japan-relevant clinical programmes (SENKU designation previously granted; ongoing clinical data presentations/updates in 2025).

South Korea - Industry Latest News 2025:

✅ 16 Jan 2025 — Korea University published/announced research describing a potentially safer long-term HBV treatment approach and highlighted rising CHB prevalence / reactivation risks in hematologic patients.

✅ 2025 — National claims/cohort analyses (HIRA-based) and cohort establishment efforts continued to inform HBV/HCV treatment-pattern shifts and support new-therapy trials.

Europe - Industry Latest News 2025:

✅ May 2025 — EASL (European Association for the Study of the Liver) published updated clinical practice guidelines on HBV management (major guidance update for Europe in 2025).

✅ 13 May 2025 (announced) / 07 Jul 2025 (completion) — GSK moved to acquire efimosfermin (liver-disease asset) in a deal for advanced liver therapeutics (strategic M&A in European hepatology space).

Market Geographical Share:

North America holds a significant share of the global market, supported by widespread adoption of advanced antiviral therapies, strong reimbursement systems, and high awareness around early screening. The region benefits from rapid uptake of novel direct-acting antivirals (DAAs) and strong public health programs focused on reducing viral hepatitis prevalence.

Asia-Pacific accounts for one of the fastest-growing shares, driven by a high burden of hepatitis B and C infections, large patient pool, and improving access to antiviral drugs in countries such as China, India, and Japan. Rising government funding, expansion of screening programs, and growing penetration of generic antivirals significantly strengthen regional growth.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/hepatitis-b-and-c-therapeutics-market

Key Market Drivers:

✅ Rising Global Prevalence of Hepatitis B & C

The high incidence of chronic hepatitis infections worldwide continues to push demand for antiviral therapies, interferons, and combination regimens. Growing screening initiatives are identifying more untreated cases, expanding the treatable patient population.

✅ Advancements in Antiviral Drug Development

The introduction of highly effective direct-acting antivirals for hepatitis C and new therapeutic combinations for hepatitis B has transformed treatment outcomes, reducing viral load more effectively and improving sustained virologic response rates.

✅ Expansion of Government Vaccination & Awareness Programs

Public health campaigns, vaccination drives for hepatitis B, and expanded screening programs for both hepatitis B and C encourage early detection and accelerate treatment uptake across developing and developed nations.

✅ Increasing Availability of Generics

The widespread availability of generic antiviral drugs in emerging markets has improved affordability, making effective treatment accessible to a larger patient population and boosting market consumption.

✅ Growing Healthcare Expenditure & Access to Treatment

Rising healthcare spending, improved reimbursement in developed regions, and the expansion of community health centers in emerging economies collectively support higher adoption of hepatitis therapeutics.

✅ Rising Focus on Hepatitis Elimination Targets

Global commitments to eliminate viral hepatitis as a public health threat by 2030 are driving investment in diagnostics, drug development, and large-scale treatment programs, significantly supporting market growth.

Segments Covered in the Hepatitis B & C Therapeutics Market:

By Indication (Hepatitis B (HBV), Hepatitis C (HCV))

By Route of Administration (Oral, Injectable)

By Distribution Channel (Hospital Pharmacies, Retail Pharmacies)

Regional Analysis for Hepatitis B & C Therapeutics Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Buy Now & Get 30% OFF — Grab 50% OFF on 2+ reports: https://www.datamintelligence.com/buy-now-page?report=hepatitis-b-and-c-therapeutics-market

Major Key Players: Gilead Sciences, Inc, AbbVie Inc., Bristol-Myers Squibb Company, Merck & Co., Inc, Johnson & Johnson, Roche Holding AG, Dynavax Technologies Corporation, VBI Vaccines.

✅ Gilead Sciences, Inc. — Gilead is a leading liver-disease player (HBV/HCV/HDV) with a dedicated liver-disease portfolio that generated strong recurring revenue (liver-disease product sales in recent quarters were reported in the high hundreds of millions — e.g., ~$719M in Q4 2024 and ~$832M in Q2 2024), underlining Gilead’s material share of the therapeutics market for viral hepatitis.

✅ AbbVie Inc. — AbbVie is a major commercial HCV incumbent through Mavyret (glecaprevir/pibrentasvir); Mavyret remained a multi-hundred-million to billion-dollar product in recent annual reporting (listed among AbbVie’s notable products with ~US$1.3B cited for 2024), keeping AbbVie as one of the top revenue contributors in the HCV segment.

✅ Bristol-Myers Squibb (BMS) — BMS historically developed the NS5A inhibitor daclatasvir (Daklinza) for HCV (approved mid-2010s), but that product has been largely de-emphasized/discontinued over time; today BMS’s direct commercial footprint in HBV/HCV therapeutics is small relative to the market leaders.

✅ Merck (MSD) — Merck’s principal contribution to the hepatitis space is vaccines (Recombivax HB® is Merck’s recombinant hepatitis-B vaccine) rather than a large antivirals franchise; this positions Merck as important for HBV prevention (vaccine market share) but less prominent in direct-acting antiviral therapeutics versus firms like Gilead and AbbVie.

Unlimited Insights. One Subscription: https://www.datamintelligence.com/reports-subscription

Related Reports:

Alcoholic Hepatitis Treatment Market

Hepatitis B Treatment Market

Kailas Disale

DataM Intelligence 4market Research LLP

+1 877-441-4866

kailas@datamintelligence.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.